The previous article discussed seven ways in which this correction is the same as the others. This piece examines seven differences.

1. This correction is driven by biology and not economics

This driver for reduction in economic activity is a result of countries shutting down economic activity to curtail the spread of Covid-19. Because it is biological, governments are reacting with public health measures to minimise the spread of the virus, minimise the influx of sick people into the health care system, and minimise deaths for the disease.

Right now, governments are optimising public health care outcomes. They are not optimising or mitigating the effects of the slowdown on the economy. Hence there is a concern as to whether the treatment is more painful than the disease.

That means no one is sure of the tools developed to deal with an oversupply of new product (real estate recession of 1992-1995 or tech wreck of 2000-2002) or a crisis in the banking world (Lehmann Brothers 2009-2011) affecting the cost of debt and the availability of debt and the impact on employment growth apply to this situation.

2. The speed of the correction is faster than before

This Motley Fool article about the length of technical corrections, a decline of at least 10% from a recent high, points to the following.

This correction has been going for about 50 days. This is very quick. That makes the downward drop very unsettling.

For commercial real estate, that makes it harder to determine fair market value now for every asset now that the world has changed. It is hard to provide evidence for any underwriting assumptions – market rent, general vacancy, vacant carry, general vacancy – and even more difficult to determine a date by an improving economy is here to stay.

3. With interest rates so low anyhow, how does a rate reduction help?

There has been a 20-plus year decline in bond rates. A constraint on reducing rates now is they have little left to reduce.

This chart is courtesy of Trading Economics

For the commercial real estate world, return expectations have been tied to a spread from bond pricing. That 20-plus year decline in bond yields has driven capital appreciation in the asset class, and that element of driving increasing values has little room left to exploit.

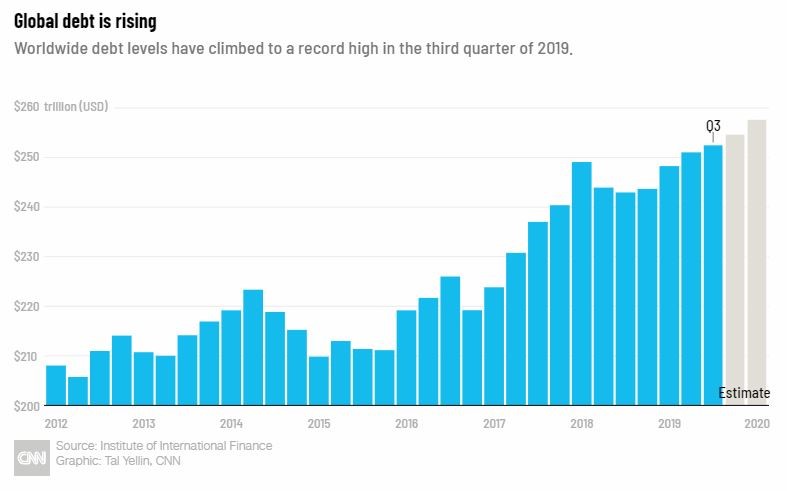

4. Overall indebtedness is up for people, firms and governments

The amount of household debt, corporate debt and sovereign debt is at an all-time high. It may not be as effective to provide even more credit to get the economies and companies going.

Long boom times inevitably have some households and firms that are only getting by and rely too heavily on inexpensive debt and suffer their demise via debt servicing or failing to roll existing debt.

5. Commercial real estate markets are fundamentally safer given the ownership profile

At the end of the commercial real estate recession in Canada from 1992 to 1995 institutions – life companies, pension funds, investment managers – had about $6 billion in assets under management. By 2020, they had $160 billion in assets under management.

The real estate investment trusts began in the mid-1990s as well. The growth from inception of five firms in1995 with a market capitalization had increased to $48 billion by 2017.

6. Social isolation means markets function poorly

Wall Street is reporting that the necessary measures to reduce the spread of Covid-19 by having traders work from home may exacerbate more defensive trading postures.

As is everyone else finding, getting the job done effectively requires proximity with colleagues.

7. Social media makes things worse not better

I saw an interview on the BBC with a person who worked for a firm that tracked bad actors on social media. For this firm, bad actors were those who consistently published incorrect information or who published misleading information intentionally and those sovereign sites looking to foster mayhem in the economy. This person said the good news is that people are finding the Center for Disease Control site for information on the Covid-19 outbreak as that web fact checker considered this to be the best source for accurate information.

That CDC site had 500,000-odd hits about Covid-19 by the time of the interview. The bad actors site had 52,000,000 hits. The CDC ratio of hits was about 1% of this total number of hits.

I saw the interview in the 2nd week of March. I suspect the bad actor hits are increasing exponentially while the CDC hits are increasing arithmetically. Not a good trend.

Misinformation is a virus as well.