I sometimes forget that people have not experienced a market correction before. It is always upsetting, confusing and relentless. No wonder the bottom is always a time of capitulation by investors. Having experienced them before does not make it any easier this time.

This is my fourth real estate market correction. There was the commercial real estate recession of 1992-1995 (at least here in Canada) following the savings and loans crisis of the late 1980s. The correction of 2000, followed by the high tech wreck or dot com burst of 2002. This was made famous by the chairman of the US Federal Reserve having declared there was “irrational exuberance” in the stock market for high tech firms. He made that declaration in late 1996, about 40 months before the correction.

The most recent correction was the post Lehman Brothers collapse of 2008 and the resultant contraction of economic activity. From a commercial real estate perspective, it was less severe in Canada than experienced in the United States.

This missive deals with seven ways in which this Covid-19 correction is the same as all the other corrections.

1. There will always be corrections and this is just another one

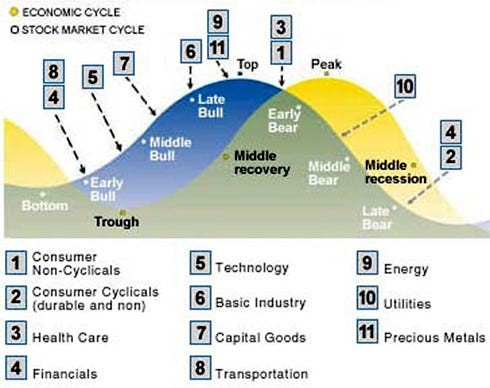

This chart from Business Insider is a good visual:

The market always follows a cycle of correction, bottoming out, slow recovery, increasing speed through the expansion, boom times and easy credit and everyone enjoying greater wealth, and a correction as something trips things up.

That there will be a correction is a given. Every market eventually gets to a stage in which market participants are less diligent about fundamentals and more inclined to believe “this time is different” The only variables are when will it occur, how severe will it be, and how long will it take to get the recovery to follow started.

There is a feeling that the greater the “irrational exuberance” before the correction, the greater the pain inflicted by the correction. The other part is that the correction is short and measured in months, while the trough to the peak is much longer and measured in years. It only feels like the correction takes forever.

2. There is always a “fog of war” while the correction is unfolding

Corrections always unfold in the “fog of war”, that idea that the battlefield is hard to figure out, the visibility to what is really happening is obscure, there is a variety of misleading information being reported, and there does not seem to time to process current conditions before the situation changes again.

It is kind of like a difference in approach to life, like Eastern and Western philosophy. The market up until the correction is notionally rational (Western), while the correction just is (Eastern). Trying to get to reasons or explanations in order to make sense of the correction may be futile, at least until well after the fact.

3. It always involves the credit market

It does not matter how it starts, it always has an impact on the credit market and the availability of debt. The late stages of the business cycle before the peak always feature the symptoms of the late stage credit cycle; less rigorous underwriting, less favourable terms for lenders, and some novel and opaque Wall Street invention to make more credit available to less credit-worthy firms.

The credit market pain is often experienced as debt matures. Now the underwriting is more stringent, the terms less favourable, and there are fewer options to explore from other potential lenders. Maturing debt rather than debt service is usually more problematic for borrowers. Not so in this correction, as the dramatic decrease in revenue that many industries are experiencing will make debt service difficult:

- bricks and mortar retailers;

- hotels;

- airlines;

- bars and restaurants; and

- movie theatres, theatres for plays, live music, theme parks, Cirque de Soleil

4. The credit market shifts immediately

The credit market has already changed. It is harder to get financing, and likely for all the right reasons. So much for the good times now we have entered the late stage credit cycle.

Getting a commercial mortgage could seem to be attractive given the reduction in bond prices. The trick will be how much principal lenders are prepared to deploy, how much more stringent their loan criteria become, and how they allocate principal to asset classes and geography. Pricing power has swung from borrowers to lenders.

5. The credit market regulators set the stage

The actions of the banks and other lenders will be under tighter control by the regulators. Much of what they will do soon will be driven by meeting guidance from the Office of the Superintendent of Financial Institutions (OSFI) for the Canadian market. OSFI will likely drive how aggressive lenders are in recovering their investment from commercial real estate investments. OSFI and the Bank of Canada are taking action to ensure that banks help the credit market function as expected in very trying circumstances.

As always, the most important institution is the US Federal Reserve. It will again be co-ordinating efforts with the Bank of England, the European Central Bank, the Bank of Japan and locally the Bank of Canada.

6. It is hard to determine property value during the correction

It is not clear if commercial real estate is a “safe haven” or a market yet to correct in lock step with equity and debt markets foreseeing much less promising economic conditions in the next 1-4 quarters.

There is no consensus as to what prudent underwriting assumptions should be, like general vacancy, projected rent growth, time for vacant carry in unoccupied suites, even availability of competing space should corporate restructurings or bankruptcies result in sub-let space coming to market. There is little market evidence to support assumptions made.

This uncertainty leads to a discussion about “price discovery”

7. It takes a while to get to the start of the recovery and back to “normal”

The recovery can take time, particularly for commercial real estate markets. It can take a while for tenants to sort out their financing, re-establish predictable revenue and emerge from a restructuring or bankruptcy.

The outcome is the same

People create and cement fortunes with their acquisitions around the trough that ends the correction.

There will be plenty of sales of good to very good real estate that will make their investors proud to have stood out of the crowd and risked “catching a falling knife”, while they secure assets they may not be able to acquire otherwise.

Good luck being brave and investing when almost no one else will.

2 thoughts on “CRE and Covid-19: what is the same in this correction?”

Great piece John.

Nice to hear from you.

Interesting analysis John. To quote Mr. Buffett, ‘ be fearful when others are greedy and greedy when others are fearful.’ A philosophy that never fails and here we are again.