Part of the current difficulty for investors to make informed decisions is that commercial real estate is a trailing indicator for the economy: whatever shocks the economy has absorbed can take a while to translate into business confidence, business failures and business creation. As well, there is little evidence to establish if Covid-19 induced changes are temporary, simply an accelerant of evolutionary change, or systemic change.

The market may have already decided the underwriting assumptions pre Covid-19 have changed. What needs to be settled is by how much. How does this Covid-19-induced effect shift the risk profile that investors seek?

Core Investment Money: praying for the good stuff to be made available

These investors are hoping and waiting for that opportunity to buy asset(s) that would normally never be available to them. These assets have few flaws and will be a prized possession for a long time. They are “Covid-19 proof” in that they have sufficient viable rental revenue to get safely through the eventual recovery to a new normal.

This is a flight to quality opportunity.

Core Plus Investment Money: why not just hold out for core?

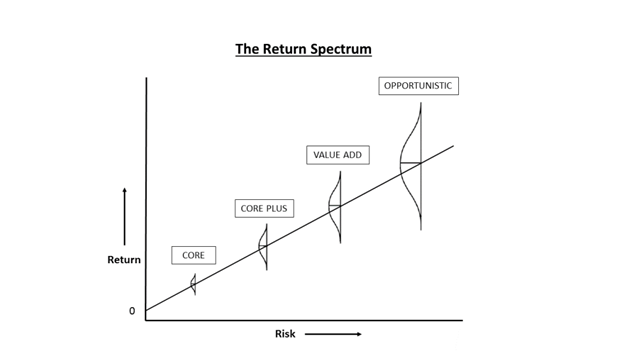

Covid-19 is making all the underwriting assumptions for rental income stability and growth harder to model. As a result, I expect investor appetite will be focused on core investments or opportunity investments, as the bid-ask spread for the core plus and value add plays will have the largest range in the appropriate underwriting assumption between sellers and buyers.

These underwriting differences can result in a bid-ask spread that puts a stop to trades for the time being. The little distribution curves for yield expectation in the illustration above have a much wider base for core plus and value add.

Value Add Investment Money: what is your baseline for adding value?

Let’s use office buildings as an example of the dilemma for value-add plays.

How do you establish market vacancy for office buildings now? How long before occupants figure out how many people will return to the office, how many days a week will they be there, and how will they use the premises when they arrive? Does the reduction in area required by having fewer people in the office daily balance the larger spacing required between employees in their premises? How does the reduction in operating costs due to lower occupancy play into underwriting value?

The struggle now is sorting out whether the Covid-19 changes are temporary, evolutionary or systemic.

Opportunistic Investment Money: is Covid-19 future-proofing enough?

Once again, the changes induced by Covid-19 health requirements may require rethinking office buildings, apartment buildings, plazas, etc. What is the “right” type of office, industrial or retail to develop or redevelop now, given how buildings are used by tenants is in the process of changing? What design features are more likely to future-proof development to secure long-term viable cash flow from credit tenants? And how does prop-tech add value to assets?

Shopify said that Covid-19 accelerated their e-commerce business levels to what they expected a decade from now. Maybe Covid-19 is similarly accelerating the redefinition of commercial real estate built forms.

Is it time for core, core plus, value add or opportunistic investing?

One thought on “CRE Covid-19 investing: which asset risk profile is in play?”

Great article Team and thanks for sending through. Professionally I think that much of what is happening, has not been created by COVID but trends that were in play and just hyper accelerated. Still early days so we ill see.

AK