No big surprise: transaction volume of sales of commercial real estate are way down since the start of Covid-19. It is a little like sailing into the doldrums, that part of the ocean where the winds die, and you can find yourself becalmed for a very long time. It can be deadly to those who rely on wind to power their journey.

What are some of the ways that Covid-19 has affected the drivers of commercial real estate and led us into the doldrums (reduced transaction activity) for an indefinite period?

Covid-19 has accelerated the impact of e-commerce on retailers and their need for stores. It has accelerated the need for logistics infrastructure to handle additional e-commerce deliveries. It has reduced air travel, business meetings and conferences resulting in little to no business travelers in hotels, and a cutback to corporate entertaining in restaurants. The potential for Covid-19 exposure getting to the office or working in the office has intensified efforts to facilitate working from home, and that affects demand drivers for the office market.

It does seem that the economic measures introduced by governments and their central banks are better attuned to the needs of big business, as opposed to small and medium sized enterprises. It feels like many of the smaller firms that make life richer in neighbourhoods – restaurants, bars, boutiques, coffee shops, craft brewers, etc. – will fail as public health measures to combat Covid-19 starve them of revenue. And that leads to distress loans, more vacant space, tighter credit requirements, increased unemployment and decreased disposable income.

Its impacts are not felt uniformly, as it seems to thrive in very large metropolitan areas (population >$5 million) and affect areas in those cities that are economically disadvantaged with people more likely to be earning hourly wages and relying on public transit to get to multiple jobs – think all those necessary employees to ensure that someone somewhere can get that e-commerce order delivered to their home.

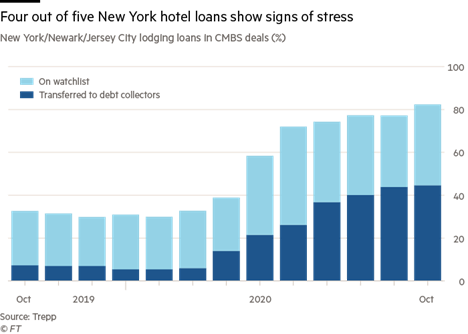

This other Financial Times article has the following chart that illustrates that impact:

Part of the difficulty for investors is that commercial real estate is a trailing indicator for the economy: whatever shocks the economy has absorbed can take a while to translate into business failures, business confidence and business creation. That eventually affects tenant demand, rental income security, and expectations for both rental income growth plus the costs to secure that growth.

Another aspect of the difficulty is the mismatch of the economic life of buildings versus the economic life of the ideal set-up for occupants to run their operations. There is a mismatch between the time frame of evolution of how people work, shop and live and the economic life of commercial real estate. That disconnect – duration risk for the bond guys – means that discontinuous change can affect some real estate more severely by exposing inherent functional obsolescence.

The doldrums could last a while. How long do you think commercial real estate will be waiting for wind?