Originally posted 29 October 2015

I always find it interesting to tour new buildings, whether office or industrial or retail facilities, as more than likely they are state of the art for all sorts of building systems, construction techniques and design considerations. The “new” days are glory days for a building – strong tenant interest, compelling competitive advantages relative to the peer set of competing buildings, no amortized capital expenses in the operating costs – and as a result the building is at its best for attracting the most desirable tenants.

The phenomenon I wish to examine is how time affects tenant appeal. At the outset, a new building appeals to the best possible tenants. Over time, that continued ability to attract and retain the best tenants erodes as a variety of factors come into play.

[For the sake of this discussion, the lens for the analysis is the steps an owner can take to retain that “new building” advantage to appeal to the best possible tenants to secure long term visible predictable cash flow from this investment. For the purposes of this discussion, I will focus on multi-storey office buildings.]

Best in Breed Tenants

Implicit in this discussion is the idea that not all tenants are created equal, and that some tenants are more desirable to lease to, given an option. Some of the preferences for owners include:

- covenant strength and visibility of that strength;

- scale of occupancy;

- vanilla use of the space (as opposed to specialized use(s));

- full floor occupancy versus partial floor occupancy;

- executes the owner’s standard lease (as opposed to the tenant’s standard lease);

- lease commitments for at least x years, where x is the owner’s (and lender’s) market expectation for the initial lease term;

- no carve outs for amortized capital costs or operating cost recoveries; and,

- no onerous use exclusions

For example, Fortune 500 companies are preferred to local firms wanting the same suite. The Fortune 500 company has more visibility to its covenant; is publicly traded; may have its debt rated; has scale of operations; has in-house real estate transaction experience; makes securing debt easier and less costly; and, can be the dominant tenant in a building.

The dilemma for owners is that the competition for Fortune 500 tenants is keen, and this is where the relative strength of a building within a chosen submarket is evidenced by best in breed interest.

The decline over time

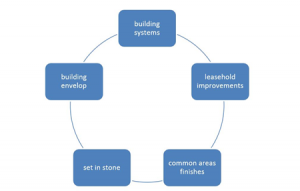

As mentioned earlier, the continued ability to attract and retain the best tenants erodes over time. The following diagram illustrates those building features that are affected by age.

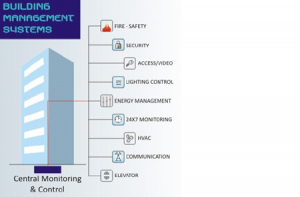

Building Systems: includes HVAC, electrical, life safety, elevators, etc. These elements all have an expected economic life (that period in which repair is the best option until such time as replacement is the only option). For many building systems, this is typically 20 years.

Leasehold Improvements: includes the specific finishes that were installed to accommodate a tenant. Leasehold improves could include partition walls, floor coverings, ceiling treatment, boardrooms, kitchens, wall coverings, HVAC and electrical distribution within their space. The landlord investment in these leasehold improvements is usually amortized over the term of the initial lease, and may otherwise have an economic life that is at most 10-15 years. Leasehold improvements older than 15 years usually have little utility for the existing or subsequent tenants.

Common Area Finishes: includes the finishes in areas necessary to get a tenant to and from its suite within a building, and areas they share if they occupy a multi-tenant building. For office buildings, common area finishes include the entrance lobby, the elevator lobbies on each floor, the corridors to get to suites, and shared washroom facilities. These areas do not have an economic life in the sense that they necessarily wear out, instead they tend to date a building. These elements need review after 20 years, more or less.

These days, common building amenities also include running WiFi in common areas, bike storage areas and showers.

Building Envelope: includes the roof, cladding, windows and, for the sake of argument, the parking structure whether at grade or a parking deck interior (underground) or exterior (parkade). The roof system will require replacement in 20 years more or less, the cladding has an economic life of perhaps 40 years, the windows eventually need replacement and if a deck, the parking structure will eventually be replaced (in that the repairs are so extensive that the structure is operationally new).

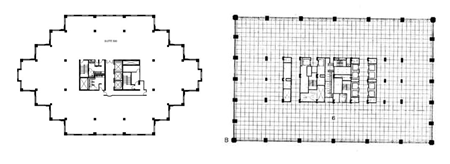

Set in stone: These are elements that just can’t be changed easily, if at all, or at less than replacement cost. “Set in stone” includes the floor plate, the slab to slab dimension, the elevator bank location, and the fire stairway dimension.

To use floor plate as an example, at one time coveted designs maximized the number of corner offices for an office building design. Next up was a shift to maximize BOMA floor space efficiency; designs looked to optimize the usable to rentable ratio to gain competitive advantages over competing buildings. More recently, there is a design criterion to ensure a “right to natural light” which results in a different floor plate profile again.

The anecdotal experience from the Ottawa CBD office district is that these “set in stone” elements cause real impediments to tenant appeal once a building is 50 plus years old. Those 1960-1970 vintage office buildings have a floor plate and a slab to slab dimension that struggles to accommodate dense floor layouts and thereby is less appealing to the best tenants.

The 20-year cycle

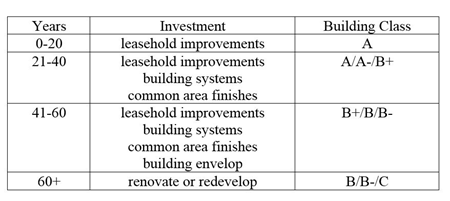

Given the above discussion, an office building owner should examine re-investing about every 20 years. More specifically, the capital re-investment schedule looks like the following:

Accelerating the Tenant Appeal downward slide

Usually within a submarket there is a fairly short list of buildings (5-10) that tenants consider equivalent. A building’s finishes and state of repair is a relative scale within this subset, and that relative scale remains in place until new supply changes tenant expectations for what the best buildings deliver. All of a sudden the existing stock seems much older.

A sustainability program, or lack thereof, is another factor that can have a negative impact on the appeal of a building.Whether captured and measured as EnergyStar or LEED or BOMA BESt or GRESB, the institutional ownership community is measuring and improving its sustainability efforts in the design, construction and operation of its office buildings. In order to remain competitive in appealing to tenants, more and more office buildings will require accreditation from these organizations, and buildings which struggle to achieve some designations will struggle with tenant appeal.

Anecdotes from Ottawa

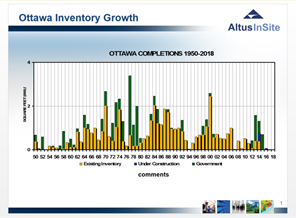

My friends at Altus shared this slide with me. It shows when the inventory in Ottawa was created, from 1950 to 2015.

Additions to supply are indicated by the bar chart. The yellow bar is private sector additions to supply, while the green bar is additions by the government, likely as a lease-purchase project. The red arrows at the top are my edit to the chart that illustrates how the 20-year cycle breaks out. It is clear that much of the existing inventory in Ottawa is getting old, and that buildings will require capital investments to maintain their appeal to the best tenants. This observation is corroborated by the Class C vacancy rate in CBD Ottawa which is about 30% in a submarket with an inventory of buildings averaging 66 years old.

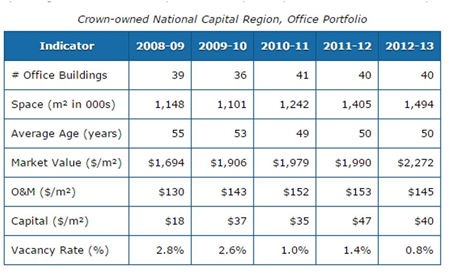

The federal government provides similar information in its most recent report: Our Portfolio Our Story 2012-2013. The following chart shows their owned portfolio in the Greater Ottawa area.

PWGSC owns a portfolio of 40 office buildings in Greater Ottawa comprising 16 million square feet with an average age of 50 years. Not surprisingly, PWGSC plans to recapitalize this portfolio over the coming years.

As PWGSC reduces the footprint of the federal government in the office space it leases in Ottawa (fewer employees and by migrating its work force to more efficient uses of the space it leases), the buildings most under pressure are those that are 40 years or older. PWGSC has been giving up space from more recently constructed buildings, but that is more likely because they are engaged in downsizing (as opposed to rightsizing), and once they receive a mandate to optimize their leased accommodations portfolio, one can expect that they will migrate from older, smaller buildings to newer, larger ones.

PWGSC exacerbates the downward slide in tenant appeal because its lease does not permit amortization of capital improvements to be recovered in operating costs. As a result, owners are reluctant to invest in capital improvements. That means that the building systems and common area finishes usually end up having an extended life span in buildings occupied by the federal government, and with PWGSC responsible for its own investment in leasehold improvements, its accommodations are certainly fully depreciated during its term of occupancy. As such, buildings with long-term PWGSC occupancy tend to “feel” older than buildings of the same vintage that are leased to private sector tenants.

Clearly Ottawa has an aging office inventory that will soon be more and more challenged to secure tenants. This will be exacerbated by the trend for tenants to reduce their space needs per employee as that means there has to be even more job growth to result in increasing tenant demand. How will this unfold for you? What steps are you taking in light of these developments?